5 Ways to Take Advantage of a Bear Market

Over the last 140 years, the stock markets have experienced many highs and lows. When the market is up we call that a "bull market." And when the market is down we call that a "bear market" especially when it's down through a prolonged period of time. During those negative cycles, more often than not, people want to “stop the bleeding” and “preserve their money”. But I would like to suggest some significant opportunities that exist when the market is down.

5 Ways to Take Advantage of a Bear Market

1. Save on Current Taxes

Most taxable portfolios will have a mix of investments – some will have gains and some will have losses. If you have an asset that has a gain, you may be able to offset the taxes owed on that gain by selling another asset with a loss. This process is called “tax-loss harvesting” and the objective is to sell a capital gain and not owe taxes.

2. Save on Future Taxes

If you have money tied up in a tax-deferred IRA, you may want to consider doing a Roth conversion while the market is down. Even though this does create a current tax liability, if you take the growth related assets in the IRA and convert them to a Roth IRA, the growth you experience over time would be Tax-Free when withdrawn instead of taxed as ordinary income.

3. Go Shopping

I don’t mean for you to go buy a new TV or car, however, you should maybe look to buy stocks with a history of paying dividends. Dividends are paid on a per share basis. Typically, you can purchase more shares at a higher dividend yield. If you look at companies with high free cash flow, dividend coverage ratio, and uninterrupted dividend history, then it is safe to think you will lock in a higher yield over the long term. Also, dividends are an excellent way to buffer the volatility of the markets.

4. Right-Size Your Risk

If you are in the middle of a market downturn and you find yourself deeply concerned or unable to sleep, this may be due to an over allocation to growth investments. Consider talking with a financial advisor to discuss the current risk profile of your portfolio. Doing this may keep you from making adverse knee-jerk reactions in the future. Click here to take our free risk assessment.

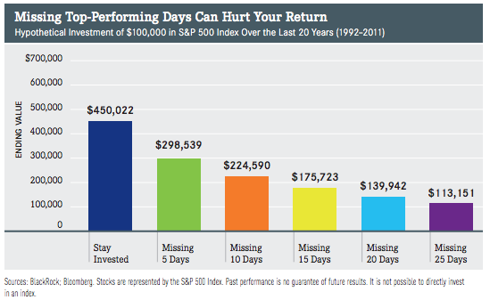

5. Nothing

Historically speaking, there have been 24 bear markets since 1928 as measured by the S&P 500. That is a period of time whereby the market has dropped at least 20%. The numbers represent an average drop of 30+% with an average duration of about a year. The average time it takes to “get your money back” after those periods was about 2 years (less than 1 year in half of the periods). If you sell out, you have to know when to buy back. These two actions are extremely difficult to time perfectly. In fact, if you look at the chart below (provided by Seeking Alpha & Blackrock) you will see that missing JUST the 10 best days of a bull market would cut your returns by almost 35% and if you missed the best 25 days you would experience an almost 75% reduction on returns. This shows that it is “Time IN” the market that more likely makes you money rather than “Timing” the market. That’s why “doing nothing” could help remove timing risk.

However you choose to look at things, there is always an opportunity to improve your current or future financial condition. If you need assistance with these ideas, find a financial advisor to walk you through implementing any of these strategies today.

Want help building YOUR Retirement Income Toolkit?